Advertising

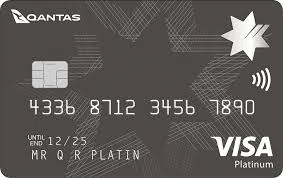

Frequent flyer aiming to earn Qantas Points with premium perks? The NAB Qantas Rewards Premium Card is a strong choice.

This card combines strong points-earning potential with complimentary travel perks, making it a solid option for Australians who want to turn everyday purchases into flights and upgrades on Qantas and its partners.

Nab Qantas Rewards Premium

Large bonus point offer for new users Annual fee appliesHow does the NAB Qantas Rewards Premium Card work?

The NAB Qantas Rewards Premium Card is a key offering within NAB’s suite of Qantas-linked credit cards, designed for frequent flyers and everyday spenders alike who want to turn purchases into meaningful travel rewards.

With this card, you can earn Qantas Points on eligible day-to-day transactions, helping you accumulate rewards simply by using your card as you normally would.

The earning structure is straightforward yet rewarding: you receive 1 Qantas Point for every $1 spent on eligible purchases, up to a cap of $3,000 per statement period. After reaching that threshold, the rate adjusts to 0.5 Qantas Points per $1 spent.

This tiered system ensures that regular spenders continue to benefit, while also encouraging strategic use of the card for maximum point accumulation.

One of the standout features of this card is the automatic transfer of points to your Qantas Frequent Flyer account. Once transferred, these points can be redeemed for a wide variety of travel-related rewards.

You can use them to book flights on Qantas and its airline partners, upgrade existing bookings, or even reserve hotel stays, rental cars, and other travel experiences.

This seamless integration between card usage and the Qantas rewards ecosystem adds real value for those who prioritize travel in their lifestyle.

To further enhance its appeal, the NAB Qantas Rewards Premium Card comes with a compelling introductory bonus for new cardholders.

By meeting the minimum spending requirement within the first 60 days of opening the account, you can unlock a large batch of bonus Qantas Points.

Main benefits of the NAB Qantas Rewards Premium Card

One of the biggest strengths of this card is its travel-friendly benefits. It includes complimentary international travel insurance, domestic and overseas rental vehicle insurance, and purchase protection, helping you feel more secure when you’re away from home.

The card also offers up to 44 days interest-free on purchases, giving you more breathing room if you pay your balance in full each month.

As a Visa credit card, it’s accepted worldwide, and NAB provides a dedicated concierge service to help with travel planning, event bookings, or gift arrangements—an often-overlooked perk for cardholders.

In terms of Qantas loyalty, earning points on everyday spending—plus the bonus offer—can add up quickly, especially if you’re planning a major trip.

You will be redirected to the official website

Cons of the NAB Qantas Rewards Premium Card

Despite its advantages, there are a few considerations. First, the card has a $250 annual fee, which may not be ideal for users who don’t travel often or won’t spend enough to justify the fee through rewards.

The points cap also limits how much you can earn each month at the higher rate, which could reduce its value for high spenders. Once you pass the $3,000 monthly spend, your earning rate drops by half.

Additionally, the interest rate on purchases and cash advances is relatively high, sitting around 19.99% p.a., so carrying a balance can become costly.

While the card offers travel insurance, it comes with eligibility requirements and exclusions, so it’s essential to read the policy carefully to ensure coverage.

Fees and terms

The annual fee is $250, and there’s an additional cardholder fee of $65 if you want to share the account. As mentioned, interest rates for purchases and cash advances are on the higher side, making it crucial to pay your balance in full whenever possible.

There’s no foreign transaction fee waiver, which might be a drawback if you travel internationally and make frequent purchases in other currencies.

That said, the value of Qantas Points—when used wisely for flights and upgrades—can offset these costs for frequent travelers.

How to apply for the NAB Qantas Rewards Premium Card

You can apply online through the NAB website. Applicants must be 18 years or older, a permanent Australian resident, and earn at least $35,000 per year. A credit check is required, and approval depends on your credit profile and income stability.

Once approved, you’ll receive your card and can start earning Qantas Points immediately. Be sure to link your Qantas Frequent Flyer account during the setup process to ensure seamless point transfers.

The NAB Qantas Rewards Premium Card is best suited for travelers who regularly fly Qantas and want to earn points quickly without sacrificing premium features. If used strategically, it can be an efficient tool for turning your spending into future travel rewards.