Advertising

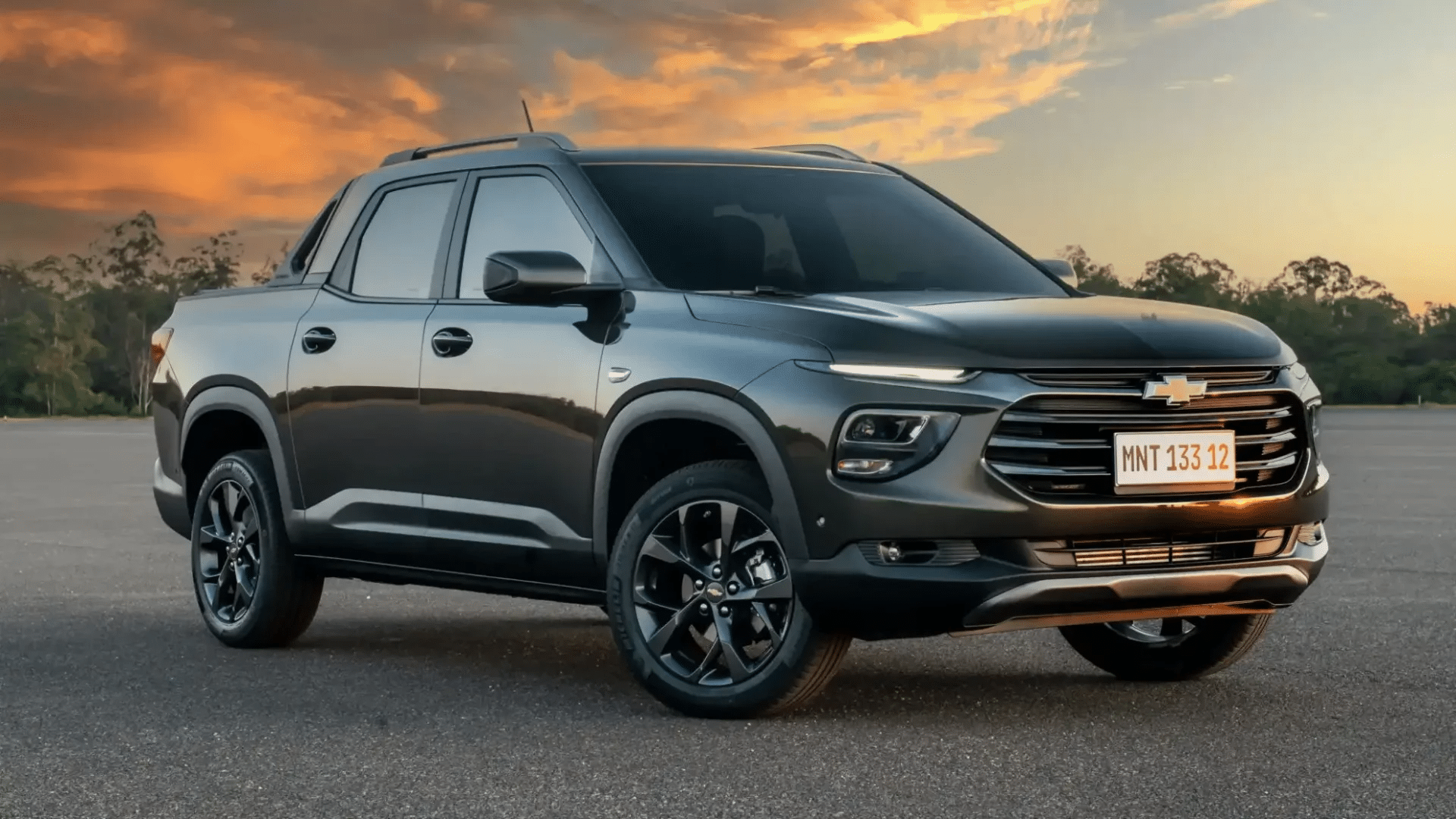

Chevrolet isn’t just a trusted automaker—it also offers financing solutions tailored to help drivers get behind the wheel of their favorite models.

Chevrolet Auto Financing combines manufacturer-backed offers with competitive rates, loyalty incentives, and flexible terms.

Whether you’re shopping for a brand-new Silverado, an electric Bolt EUV, or a certified pre-owned Equinox, Chevrolet provides financing options that align with different budgets and lifestyles.

With financing support available directly at Chevrolet dealerships nationwide, customers benefit from streamlined approvals, special promotions, and financing programs designed to reward brand loyalty.

-

+ Exclusive Incentives+

Enjoy limited-time offers like 0% APR financing or cashback on select models.

-

+ Flexible Loan Terms+

Choose between short or long-term financing to fit your budget.

-

+ Certified Pre-Owned Advantage+

Access lower rates and warranty-backed vehicles with certified financing.

-

+ Loyalty Discounts+

Returning Chevy customers benefit from added savings and perks.

Top Auto Loan Options in the U.S.

Bank of America Auto Loans: Strong digital tools and competitive APRs.

Chase Auto Loans: Wide dealer network and flexible payment terms.

PenFed Credit Union: Member-based financing with some of the lowest APRs.

Ally Auto Loans: Digital-first lender offering broad flexibility.

Chevrolet Auto Financing: Manufacturer-backed deals, loyalty offers, and certified pre-owned options.

Traditional Bank Loans

Reliable but may lack manufacturer-specific promotions.

Chevrolet Financing

Captive lender advantage with exclusive discounts and seasonal incentives.

Credit Unions

Offer great APRs but without manufacturer perks.

Online Lenders

Quick and digital, though not tied to vehicle promotions.

Buy Here Pay Here

Accessible but often comes with high long-term costs.

How Auto Loans Affect Credit & Finances

Financing through Chevrolet Auto Financing has a direct impact on your credit profile. By making timely monthly payments, borrowers can steadily build or strengthen their credit history.

A strong payment record not only keeps you in good standing but also positions you for better financing rates in the future.

However, missing or delaying payments has the opposite effect. Negative marks on your credit can remain for years and make future borrowing more expensive.

This is why Chevrolet encourages automatic payment setups through its financial services, helping borrowers avoid missed due dates.One advantage of financing through a manufacturer like Chevrolet is the opportunity for special refinancing or loyalty programs.

These offers can reduce your payment burden while keeping you in the Chevrolet family of vehicles. By refinancing to a lower APR or securing new promotional rates, customers often save thousands over the life of the loan.

You will stay on our website.