Advertising

Many credit cards promise exciting rewards, but not everyone is looking for flash.

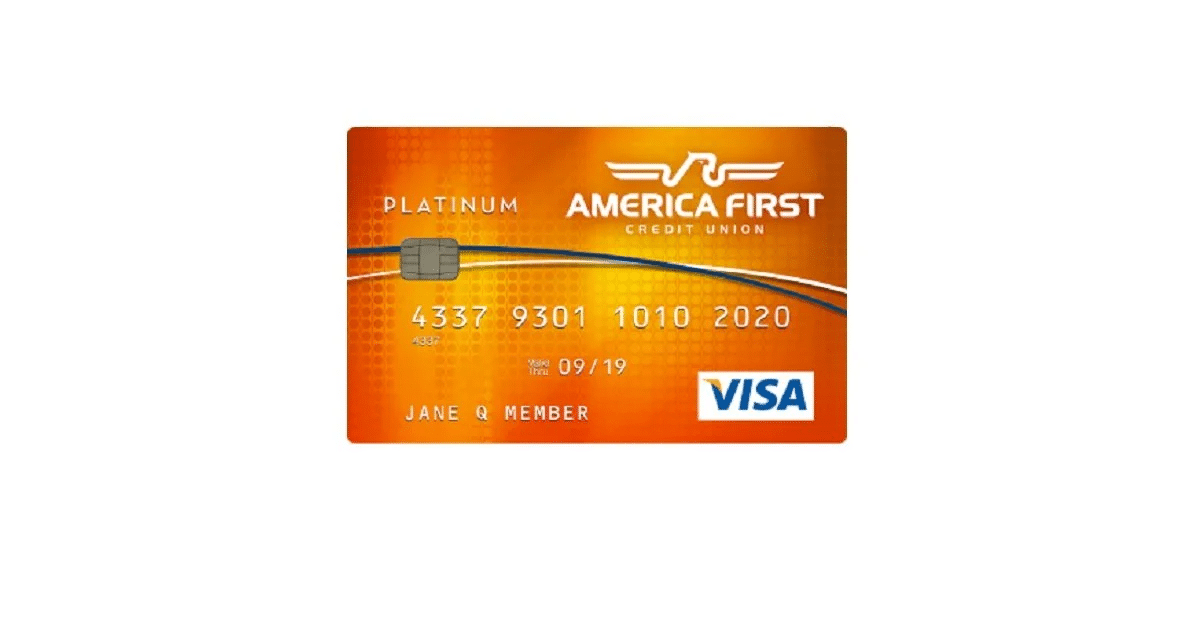

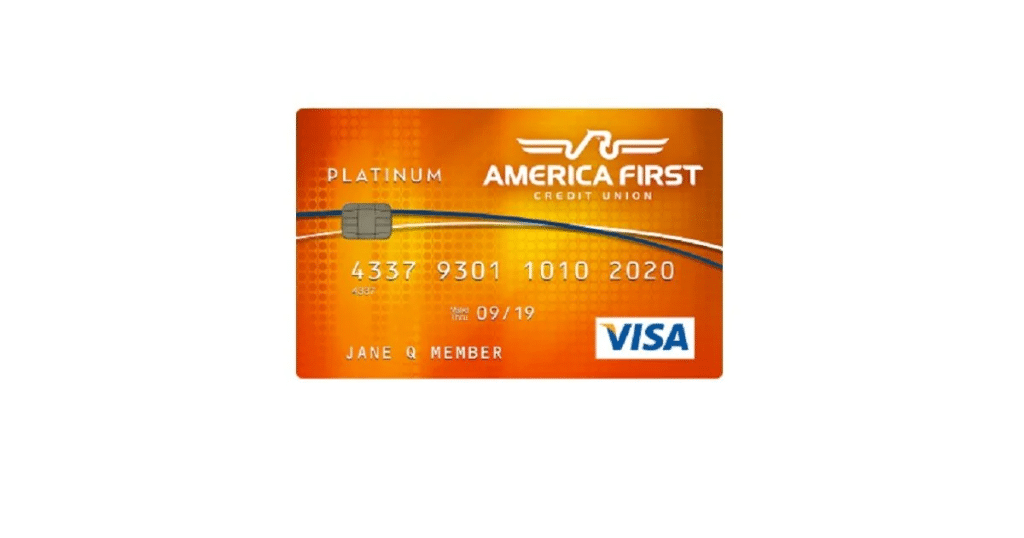

Some people simply want a dependable, fair credit card that does its job quietly and efficiently. That’s exactly what the America First Credit Union Classic Visa delivers. This card is straightforward, stable, and perfectly suited for those who prioritize responsible credit use.

There’s no need to worry about annual fees eating into your savings. The Classic Visa charges none, which makes it a low-risk addition to your financial portfolio.

It’s especially helpful for those who are building their credit, since it provides a solid foundation without the cost of entry that many other cards require.

The card doesn’t dazzle with points or bonuses, but it offers what really matters—competitive interest rates and a clear path toward better credit. You get all the essentials: fraud protection, mobile app access, and reliable customer service.

This is the kind of card that quietly supports your financial goals, even if it’s not the flashiest tool in your wallet.

America First Credit Union Classic Visa Credit Card

No annual fee Strong fraud protectionHow the America First Credit Union Classic Visa Works

The Classic Visa operates as a no-frills credit card, designed for users who want basic access to credit without unnecessary bells and whistles.

Once approved, you’ll receive a credit limit based on your creditworthiness, and your account will link directly to your America First Credit Union account if you’re a member.

You can use the card anywhere Visa is accepted, and transactions are secured by standard safety protocols, including chip technology and fraud monitoring.

Payments and account management are simple through the America First mobile app or website, making this a good fit for users who want a clean and easy interface.

Your APR will vary based on your credit score, but the rates offered are typically lower than what you’d find on unsecured cards from traditional banks. This can help reduce your overall interest costs if you occasionally carry a balance.

Key Advantages of the America First Credit Union Classic Visa

One of the biggest advantages is financial predictability. With no annual fee, your costs remain low, even if you don’t use the card every month. This makes it ideal as a backup credit card or for occasional purchases that help build your credit profile.

The low-to-moderate APR also stands out, especially for those with decent credit. It offers an affordable solution for anyone who needs to carry a balance short-term without racking up significant interest. This is a subtle benefit, but one that can save you hundreds over time.

Security features are also strong. The zero-liability policy protects you from fraudulent transactions, while real-time alerts help you stay on top of your spending. It’s not flashy, but it’s highly effective—just what you want in a card that’s meant to provide stability.

Finally, we should note the benefit of working with a credit union. America First’s customer service consistently gets high marks, and its local focus means you’re not just a number in a massive system. That’s a rare and welcome change.

You will be redirected to the official website

Disadvantages of the America First Credit Union Classic Visa

While it performs very well in its category, this card isn’t for everyone. If you’re chasing travel rewards, dining perks, or large welcome bonuses, this one will likely disappoint. There are no rewards points, cash back, or member-exclusive experiences.

Another drawback is that it doesn’t offer introductory APR promotions. Some people look for cards that give them 0% interest for the first 12 to 18 months, especially when transferring balances or financing large purchases. This isn’t one of those cards.

Also, while the credit union’s local focus is a strength, it might be a limitation for those who prefer nationwide or international customer service access. America First may not have the same infrastructure as bigger banks in terms of rapid response or 24/7 phone support.

Lastly, it’s worth noting that this card is best for those with good to excellent credit. Applicants with lower credit scores might not qualify, or could receive less favorable terms.

APR and Fees Overview

The APR on the Classic Visa is variable and based on your credit rating. While rates may not be as low as secured credit union cards, they are still much more competitive than many unsecured bank credit cards.

There is no annual fee, which is a major plus. Foreign transaction fees may apply, so if you travel often, be aware of that limitation. Late payment and returned payment fees are in line with industry averages but can still impact your budget, so setting up auto-pay is a smart move.

Overall, the fees are transparent and manageable, helping users avoid financial pitfalls and focus on positive credit habits.

How to Apply for the America First Credit Union Classic Visa

To apply for this card, follow these steps:

- Check Your Credit Score: Ensure you meet the typical approval criteria for good to excellent credit.

- Become a Member: If you’re not already a member of America First Credit Union, you’ll need to join to be eligible.

- Apply Online: Visit the America First Credit Union website and complete the application form.

- Provide Identification and Income Info: Standard requirements include proof of income, a Social Security number, and a government-issued ID.

- Wait for a Decision: Most applications are reviewed within a few business days, though some may receive instant approval.